|

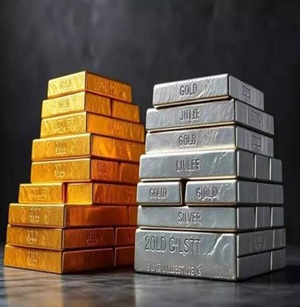

Gold and Silver Surge to Records on Geopolitics, Dollar Weakness 26-12-2025 02:30 PM Gold and silver jumped to all-time highs, with escalating geopolitical tensions and US dollar weakness helping to extend a historic rally for precious metals. Platinum also hit a record. |

06-02-2026 1:30 PM Dhirsons Jewellers Pvt. Ltd., a part of the Dhiraj Dhir Group and a trusted name in Lajpat Nagar, New Delhi, proudly presents the “Temple Treasures” collection, showcasing at their flagship store in New... |

06-02-2026 1:25 PM EKARAA announces its entry into India’s fine jewellery landscape with the opening of its first flagship store in Mumbai, introducing a contemporary luxury jewellery house conceived for the modern Indian woman and... |

06-02-2026 1:20 PM TT Devassy Jewellery, a house synonymous with designer-made fine jewellery, marked 85 years of creative excellence with the unveiling of a curated heritage collection at The Grounds, Chakola Mill, Kochi. The... |

06-02-2026 1:15 PM Men of Platinum, the men’s jewellery brand from Platinum Guild International (PGI) India, brought its highly anticipated #MomentWithMahi campaign to a thrilling close with an exclusive fan meet-and-greet with MS... |

06-02-2026 1:10 PM Danish jewellery maker Pandora (PNDORA.CO), opens new tab will start selling platinum-plated versions of its best-selling bracelets, the company said on Wednesday, as it tries to limit the impact of a historic... |